That may be you ultimate goal. If your parent who is a sibling of the deceased is still alive then your parent would inherit everything if the will is set aside and nothing would go to you.

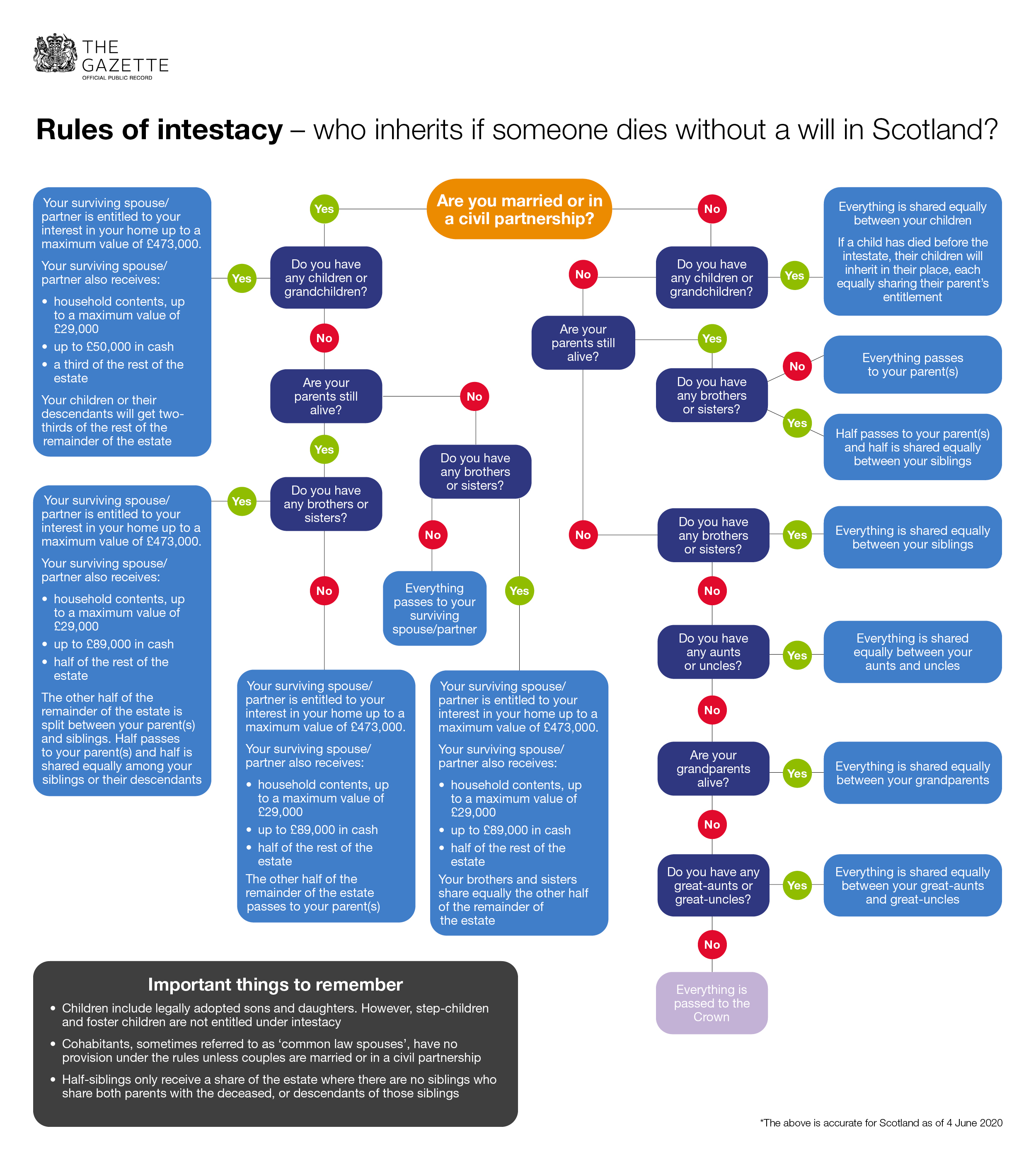

What Are The Intestacy Rules In Scotland The Gazette

This is because they will inherit fully their share.

. 1 Lawyer Answer Moshe Toron Esq. In that case theres no tax. Therefore if an aunt or uncle leaves a niece or nephew 500 or more there will be a tax on the entire amount.

Their share in the inheritance will be on a per stirpes basis. Inheritance tax can also be avoided through the use of an irrevocable trust under certain circumstances Miller said and can be used to pay expenses for the benefit of your nieces and nephews. If you are an interested party you can contest a will in Texas.

At the very core of leaving an inheritance is the process of writing a will. Allaah Says about sisters what means. The same is true regarding nieces and nephews when the deceased has no children or siblings alive.

Children in California Inheritance Laws. Answered 2 years ago. All nieces and nephews from the same aunt or uncle have the right inherit equally unless stated otherwise in the will of the aunt or uncle who died but you can only share the inheritance share of your deceased parent so you may inherit unequally with your cousins.

This is subject to conditions. If there are two sisters they shall have two-third of the inheritance. His sisters will get two-thirds as their right of inheritance since they are more than one.

Inheritance tax is however imposed on transfers to nieces and nephews Class D beneficiaries. However your rights are of lower priority than those of your aunt or uncles more immediate family members. However a niece from a brother.

You may qualify for Favourite Nephew or Niece relief if you receive a gift or inheritance of business assets. However circumstances and relationship may change from the time a will is made to the date of death. Estate Planning Lawyer Cincinnati OH.

If so how would we prove we are my aunts surviving paternal nieces and nephews. Leaving an Inheritance to a Niece or Nephew Write a Will. The relief allows the use of the Group A threshold.

Yes Nieces and Nephews can contest a will in Texas. If all thirteen children are the children of the one brother it remains thirteen shares with the deceased nieces 113 share going to her descendents. The child of the disponers brother the child of the disponers sister.

Nieces and nephews inheritance laws endow you with certain rights to your aunt or uncles inheritance. The tax rate is between 15-16 depending on the amount transferred. The inheritance tax rate on transfers to nieces and nephews is 15 in New Jersey.

As set forth in the laws of the state of New York you have no rights to your aunt or uncles inheritance if they had a living spouse descendants or. This will depend on a number of circumstances. Nieces and Nephews Inheritance Law in Estate of Aunt or Uncle.

As set forth in the laws of the state of New York you have no rights to your. For the purpose of this relief you are a nephew or niece if you are. Again only if there is no surviving spouse children etc.

Children nephews and nieces UV W and X will inherit by representing their father A. If there is no one of them except sons and daughters of the sisters nieces and nephews then the entire inheritance is for them. However we cannot explain how to divide the inheritance between them until we know whether the sisters are all full-sisters or half-sisters from the fathers side only or from the mothers side only or that some of them are from the.

There is an exception if the bequest is less than 500. Nieces and nephews includes children of step-brothers and. In Texas Parents siblings aunts uncles nieces nephews and others are heirs for the purpose of distributing the estate of the deceased if he died intestate and if the deceased had no spouse or children.

There is no inheritance tax imposed on transfers to a parent grandparent spouse domestic partner child or step-child Class A beneficiaries. We have lived in the UK for over 30 years. The shares of the siblings B C and D who are still alive are greater than that of the nephews and nieces UV W and X.

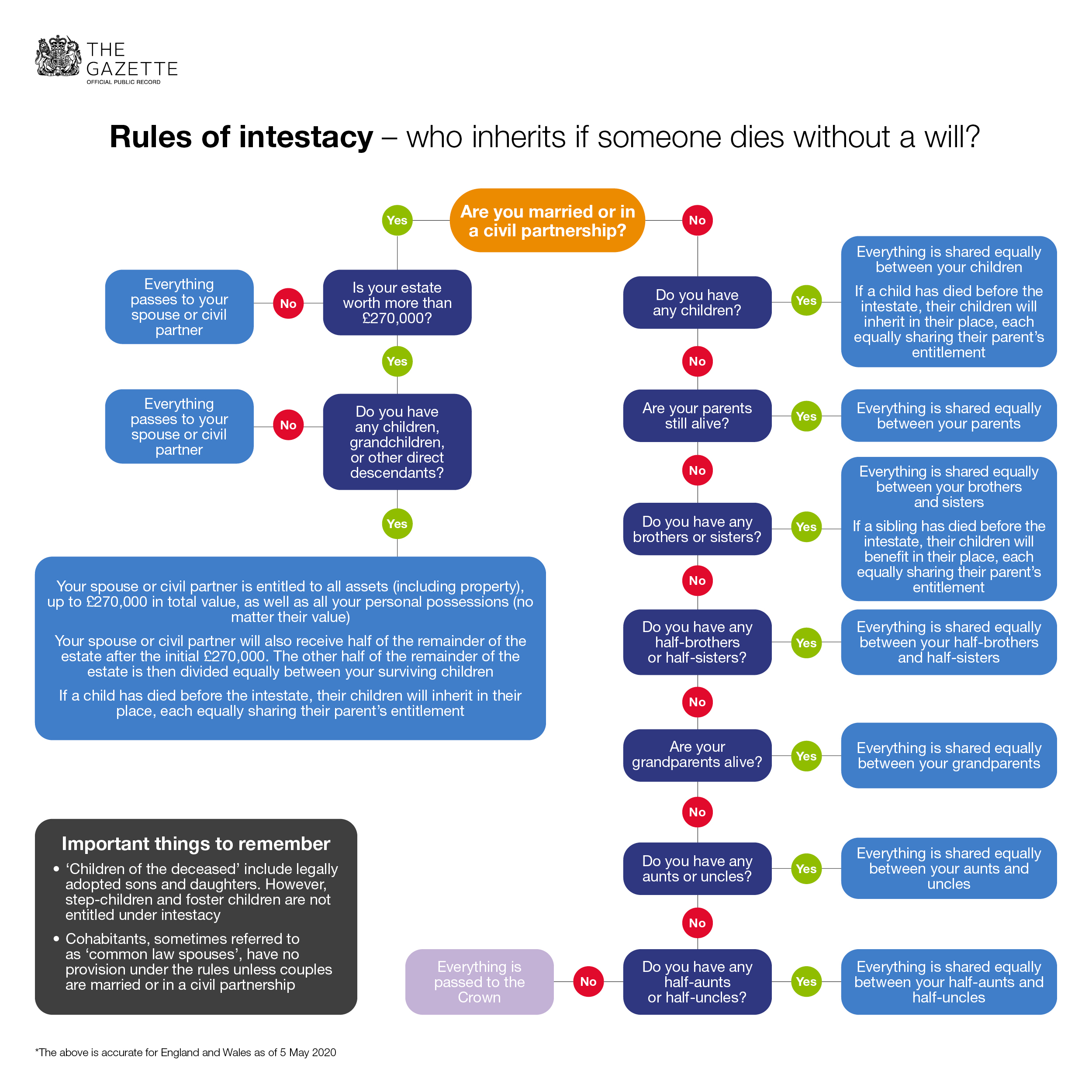

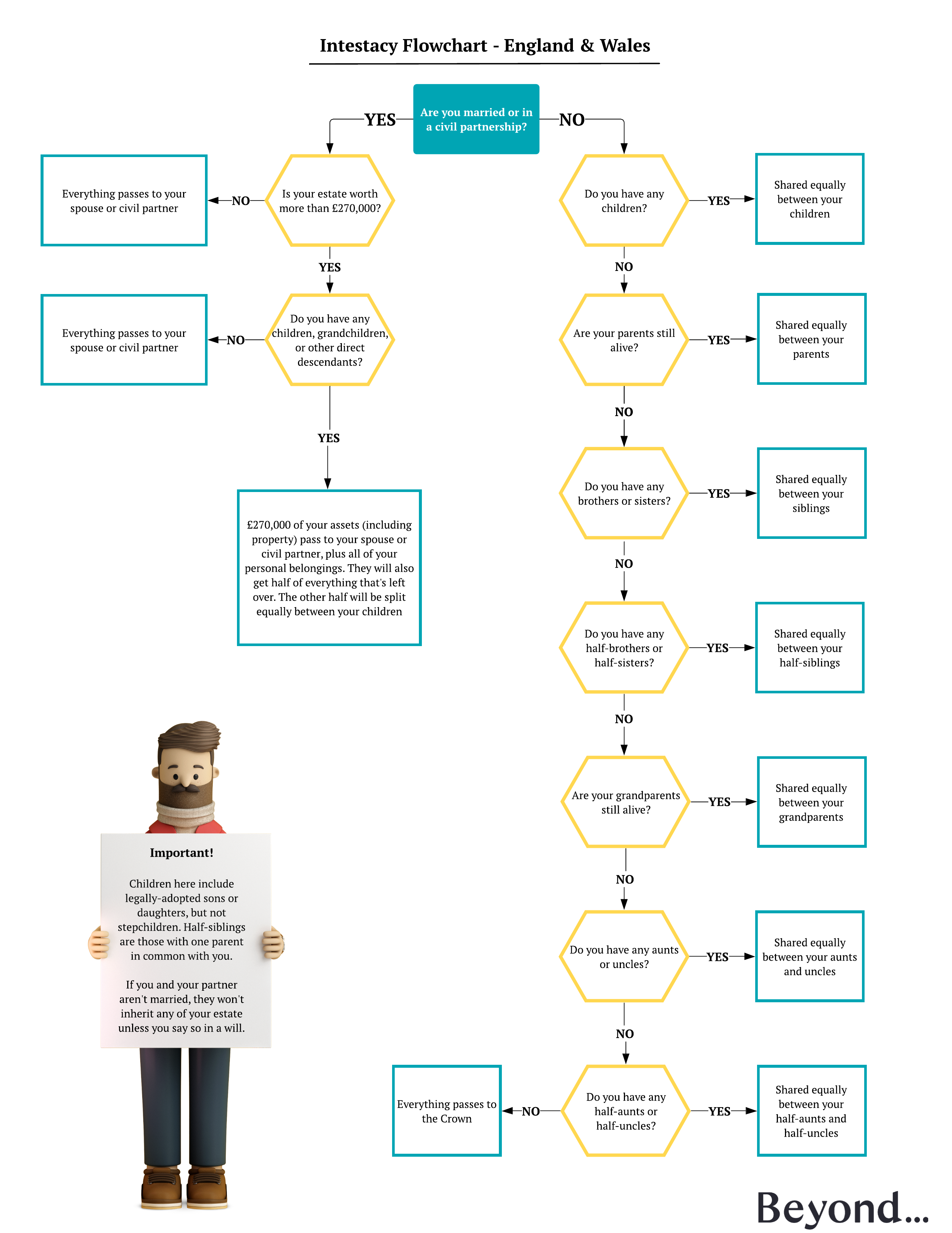

If youre wondering how to leave an inheritance to a niece or nephew taking the right steps doesnt have to be as difficult as you might think. Even if the deceased had a spouse but no children the other relatives may be entitled to some of the property. Parents brothers and sisters and nieces and nephews of the intestate person may inherit under the rules of intestacy.

This includes nieces and nephews. A nephew takes priority over a niece from that same sibling. Whether the will contest will benefit you depends on several factors.

However your rights are of lower priority than those of your aunt or uncles more immediate family members. My wifes natural father died when she was very young but until recently 2 of his brothers wre. If someone wishes to leave a gift to their nieces and nephews in their will it should be a simple matter to identify which individuals are a niece or a nephew and so entitled to share in the inheritance.

Whether there is a surviving married or civil partner whether there are children grandchildren or great grandchildren. Inheritance rights of nieces and nephews endow you with certain rights to your auntss or uncles inheritance. If there are no surviving siblings then the surviving nieces and nephews of those siblings are awarded inheritances equally divided amongst surviving nieces and nephews.

Inheritance of nephews and nieces. In this case do nieces and nephews have inheritance rights. This however requires giving up control and use of the assets placed in trust.

Inheritance rights of nephewsnieces 2008630 2322 I am British and am married to a Japanese woman. The division is between the decedents siblings with the neices and nephews of a deceased sibling dividing their parents share and the same being true for their descendents. Before getting into the specific laws that surround the inheritances of children in California its important to know how the state qualifies who is and isnt an individuals child even if it might seem obvious.

Your Eminence one of two full brothers died leaving behind two sons and two daughters. First and foremost biological children have the strongest rights as they are the direct bloodline of the decedent. After around 5 years their uncle died and there was no one to inherit him except his brothers children.

If someone dies and leaves behind some sisters and nephews and nieces from brothers and sisters then his inheritance will be divided as follows.

Intestacy Rules Intestacy Rules Flowchart Dying Without A Will

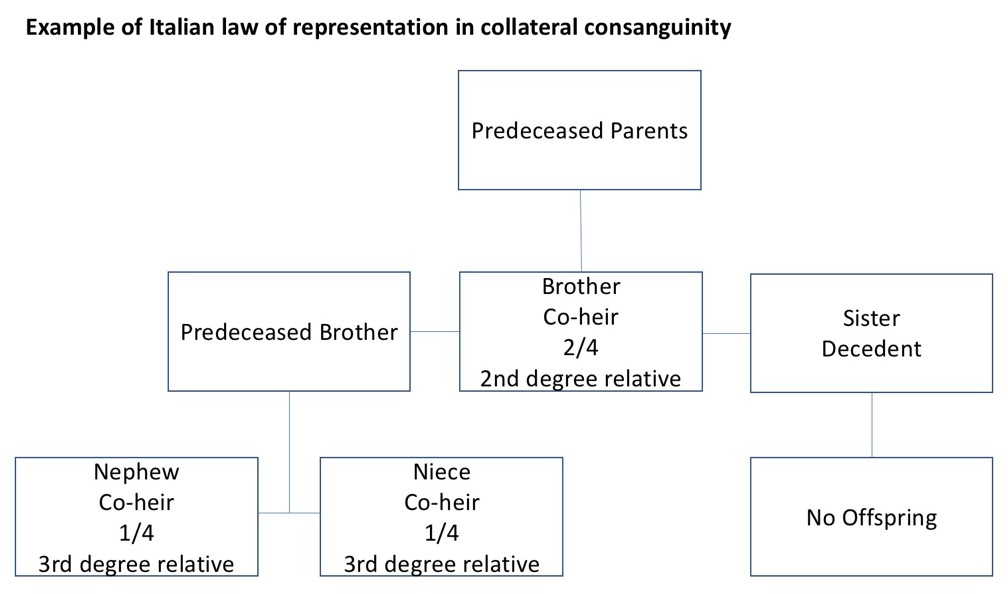

The Right Of Representation In Italian Inheritance Law Italian Solicitor

There S Been A Huge Jump In Inheritance Tax Takings And Nieces And Nephews Are Hit The Most

Nieces And Nephews Leaving Them An Inheritance By Your Will

What Are The Intestacy Rules In England And Wales The Gazette

Inheritance Rights Of Nieces And Nephews Rights To Distribution And Info

0 comments

Post a Comment